Online version: February 2021

Emeriane Avocats, as data controller, attaches particular importance to the protection of your personal data.

More information on the dedicated page.

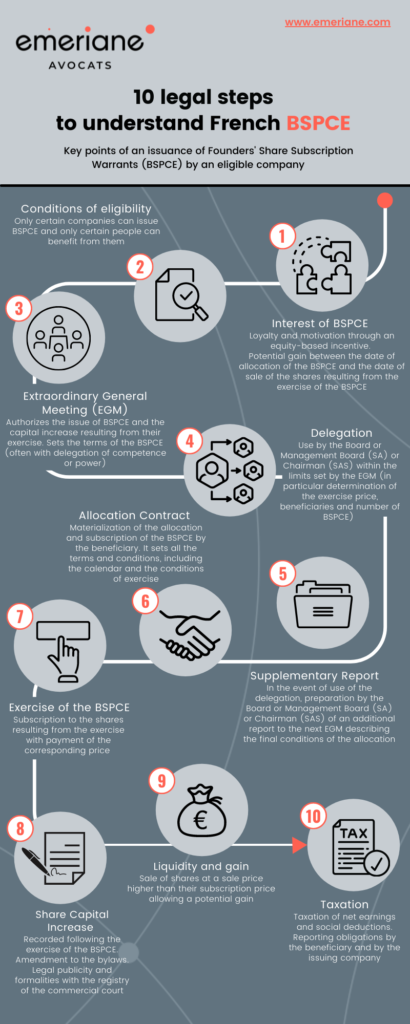

Founders’ share subscription warrants “BSPCE” are granted for free to their beneficiaries and give them the right to subscribe for shares in their company at an exercise price definitively determined on the date of grant.

BSPCE thus offer an opportunity of making a financial gain in the event of increase of value of the share between the date of allocation of the BSPCE and the date of sale of the share resulting from the exercise of the BSPCE (financial gain = sale price of the share resulting from the exercise of the BSPCE – exercise price of the BSPCE).

BSPCE allow innovative companies (including start-ups) to retain and motivate their employees through a profit-sharing scheme and allow them to diversify their remuneration methods.

I. Checking the conditions for allocating BSPCE

Issuing companies must meet the following conditions at the time they allocate BSPCE and for as long as they wish to allocate them :

BSPCE may be allocated by corporations (i.e., sociétés anonymes (SA), sociétés par actions simplifiées (SAS) and sociétés en commandite par actions (SCA)). Sociétés à responsabilité limitée (SARL), sociétés en commandite simple and sociétés en nom collectif (SNC) can not allocate BSPCE.

The company must also meet specific criteria (except in the specific case of a company resulting from a merger, restructuring, expansion or takeover of activities) :

(i) be either an unlisted company or a listed company with a market capitalization of less than €150 million (in the event that the market capitalization exceeds this limit, it is possible to issue BSPCE in the three years following this limit being reached)

(ii) be registered in the Trade and Companies Register for less than 15 years at the time of allocation of the BSPCE

(iii) be subject to corporate income tax in France

(iv) have been directly and continuously held since its incorporation for at least 25% by natural persons or legal entities themselves directly held for at least 75% by natural persons

Beneficiaries eligible for BSPCE :

(i) employees of the issuing company

(ii) managers subject to the employee tax regime (e.g. Chairman of the Board of Directors, Chairman of a SAS, Executive Director(s), Deputy Executive Director(s) and members of the Management Board for SAS with a Supervisory Board and Management Board)

(iii) members of the Board of Directors (or Supervisory Board for SA or, for SAS and foreign companies, of any equivalent statutory body)

II. Decision of the Extraodinary General Meeting (EGM)

The issuance of BSPCE must be authorized by the EGM and implies that the latter cancels the preferential subscription rights of the shareholders for SA (or of the partners (associés) for SAS) or that the latter waive their preferential subscription rights. The EGM decides on the report of the Board of Directors or the Management Board in the case of a SA (or of the Chairman for SAS) and on the report of the statutory auditor, if any.

The EGM may decide to issue the BSPCE and the corresponding capital increase resulting from the exercise of the BSPCE or delegate its authority to the Board of Directors or to the Management Board for SA (or to the Chairman for SAS) to decide to increase the capital on one or more occasions.

The decision to issue the BSPCE entails the waiver by the shareholders for SA (or by the partners (associés) for SAS) of their preferential subscription right to the capital securities to which the issued BSPCE give right.

It is up to the EGM to determine the period during which the BSPCE may be exercised as from their issue.

The EGM can determine the acquisition price of the shares to be subscribed for in case of exercise of the BSPCE, the list of beneficiaries and the number of BSPCE allocated to each of them. The EGM can delegate this power to the Board of Directors or to the Management Board for SA (or to the Chairman for SAS).

In the event of delegation by the EGM, the BSPCE must be allocated within 18 months of the decision taken by the EGM to issue them.

The delegation to the Board of Directors or to the Management Board for SA (or to the Chairman for SAS) avoids the need to convene an EGM for each allocation of BSPCE.

Within the limits set by the EGM (and the maximum duration of the delegation of 18 months), the Board of Directors or the Management Board for SA (or the Chairmanfor SAS) will be able to determine the exercise price of the BSPCE, to indicate the names of the beneficiaries and the number of BSPCE they will each receive.

In case of use of the delegation, the Board of Directors or the Management Board for SA (or the Chairman for SAS) will have to prepare a supplementary report to the next ordinary general meeting describing the final conditions of the allocation. As applicable, this report must be certified by the statutory auditor.

Note : the determination of the exercise price of the BSPCE is regulated by law.

III. BSPCE allocation contract

In order to formalize the allocation of BSPCE and their subscription by the concerned beneficiary, an allocation contract is formalized and signed by the beneficiary and the issuing company. This contract specifies in particular the number of BSPCE allocated, their exercise schedule, their exercise price and, more generally, all terms and conditions governing them.

BSPCE are non-transferable (in the event of the beneficiary’s death, they may be exercised by his or her heirs within six months of the death)

Points of attention in the allocation contract :

IV. Exercise of BSPCE : subscription notifications from the beneficiaries with payment of the corresponding price

In accordance with the terms and conditions of the allocation contract, in particular with regard to the exercise schedule, the beneficiary wishing to exercise his or her BSPCE will have to complete and sign the subscription form corresponding to the shares to which the BSPCE give right.

The remittance to the company of the subscription form duly filled in and signed by the beneficiary must be accompanied by the payment of the total price of the BSPCE exercised.

V. Acknowledgement of the capital increase resulting from the exercise of the BSPCE and amendments to the bylaws

Following the exercise of the BSPCE, the issuing company will record the completion of the capital increase resulting from the exercise, as well as the corresponding amendments to the bylaws.

In order to obtain an up-to-date certificate of incorporation (Kbis) of the issuing company, the legal publicity as well as the formalities with the clerk’s office of the competent Commercial Court shall be carried out.

VI. Liquidity and potential financial gain

Subject to any restrictions imposed on the transfer of the shares of the issuing company, the beneficiary who becomes a shareholder (or a partner (associé) in the case of a SAS) upon exercise of his or her BSPCE will sell his or her shares in the hope that their sale price will be higher than their subscription price (also referred to as the "BSPCE exercise price") in order to realize a financial gain (monetization of the incentive).

Point of attention : the social and tax regimes of the BSPCE must be analyzed in detail (in particular, taxation of the net gains and social deductions as well as the reporting obligations by the beneficiaries but also by the issuing company)